Q1. How long does it take to submit claims after the encounter is closed in your EHR??

You must select one option.

Q2. What percentage of claims are adjudicated within 30 days?

You must select one option.

Q3. Are you being paid at your contracted rates from your insurance companies?

You must select one option.

Q4. What is the average number of patients one provider sees on a daily basis?

You must select one option.

Q5. What percentage of your claims are denied on first submission?

You must select one option.

Q6. How often do you review coding accuracy (e.g., CPT and ICD-10 codes)?

You must select one option.

Q1. How would you rate your patient satisfaction related to billing?

You must select one option.

Q2. How long does it take your RCM vendor to submit claims after the encounter is closed?

You must select one option.

Q3. What is the average number of patients one provider sees on a daily basis?

You must select one option.

Q4. Are you being paid at your contracted rates from your insurance companies?

You must select one option.

Q5. What is your practice’s First-Pass Clean Claim Rate?

You must select one option.

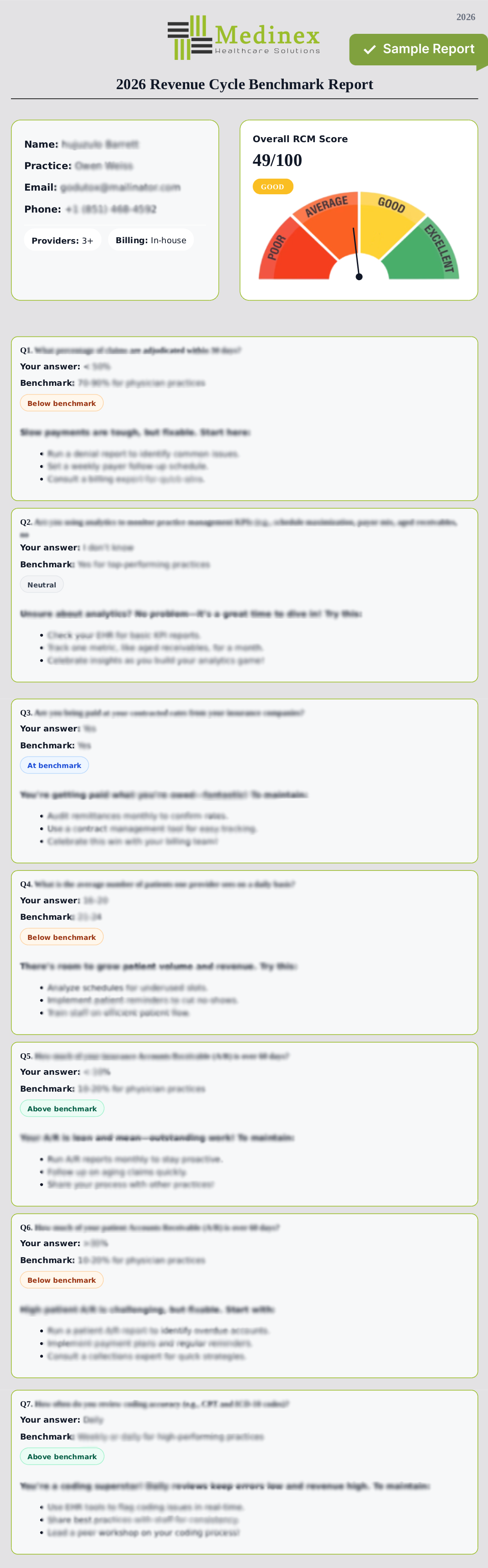

Q1. What percentage of claims are adjudicated within 30 days?

You must select one option.

Q2. Are you using analytics to monitor practice management KPIs (e.g., schedule maximization, payor mix, aged receivables, no show percentage)?

You must select one option.

Q3. Are you being paid at your contracted rates from your insurance companies?

You must select one option.

Q4. What is the average number of patients one provider sees on a daily basis?

You must select one option.

Q5. How much of your insurance Accounts Receivable (A/R) is over 60 days?

You must select one option.

Q6. How much of your patient Accounts Receivable (A/R) is over 60 days?

You must select one option.

Q7. How often do you review coding accuracy (e.g., CPT and ICD-10 codes)?

You must select one option.

Q1. How would you rate your patient satisfaction related to billing?

You must select one option.

Q2. How frequently do you use analytics to monitor RCM KPIs with your vendor?

You must select one option.

Q3. Are you being paid at your contracted rates from your insurance companies?

You must select one option.

Q4. What is the average number of patients one provider sees on a daily basis?

You must select one option.

Q5. What is your average insurance Days in Accounts Receivable (A/R)?

You must select one option.

Q6. What is your practice’s Net Collection Rate (NCR)?

You must select one option.

100% confidential. Your report will be emailed to you instantly.